What to Expect While in Repayment:

Loan repayment begins six months after you graduate, drop below half-time enrollment, or withdraw from school. Making timely payments will help you establish a good credit history and demonstrate to other creditors that you are a responsible borrower, a quality that can benefit you for many years into the future. You will generally have up to ten years to repay, and various repayment and postponement options are available if you meet certain requirements.

Keep good financial records. Get organized and keep all your student loan documents together - before and after graduation. Please make sure that OSLA has your current contact information.

Be sure to explore different repayment options, either on this website or by calling in and speaking to a Customer Service Representative.

How to Make Payments:

There are several ways that you can make payments towards your Student Loans.

-

You may mail a check or money order to the address shown below. Please make sure to include your account number in the memo line, so that we can easily locate your account to apply the payment. The payment address is:

Oklahoma Student Loan Authority

PO BOX 268885

Oklahoma City, OK 73126-8885 If you would like to make payment over the phone, you may call our Customer Service Center at 800-456-6752. We can schedule a one-time payment for you using your bank’s routing number and your checking or savings account information. Our payment system is not able to take debit or credit card payments.

-

If you would like to schedule payment online, please login on the home page and then click on the “make a payment” button.

-

If you would like to set up automatic payments using our EZPay system, you may set this up from your online account, or we can send you an application to fill out and return to us. The automatic payments will draft each month on your cycle date.

Repayment Options:

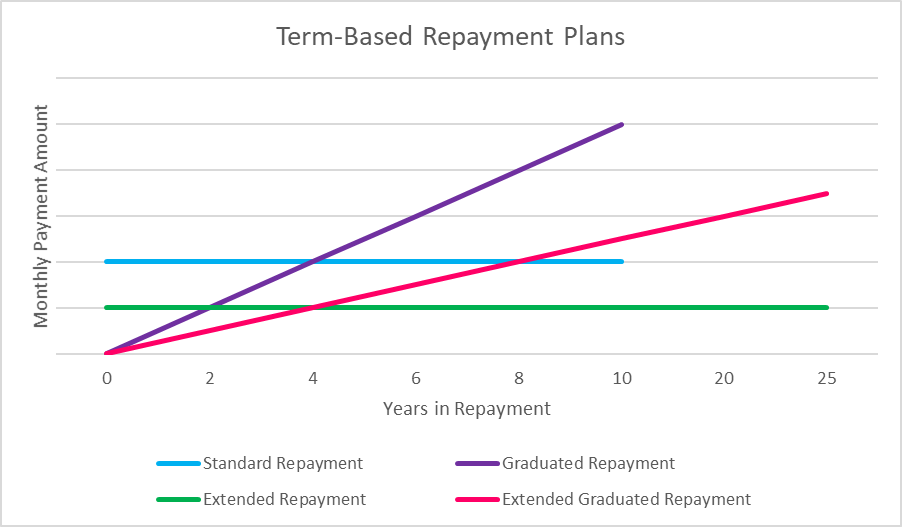

Term-Based Repayment Plans:

Standard Repayment Plan:

This plan, illustrated above in blue, is best for those wanting to pay off their loans in the quickest time frame, while paying the least amount of interest. This plan has a 10-year term and a fixed monthly payment amount.

Graduated Repayment Plan:

This plan, illustrated above in purple, is best for those who know their income will increase over time. The monthly payment starts low, and then increases every 2 years. This plan has a 10-year term, but the loans will accrue more interest than the Standard Repayment Plan.

Extended Repayment Plan:

This plan, illustrated above in both green and pink, is for those who need longer to pay off their loans. This plan can extend your loan term up to 25 years, and can have a fixed or graduated monthly payment amount. The loans will accrue more interest on this plan than the Standard Repayment Plan. In order to qualify for this plan, you must have at least a $30,000 balance.

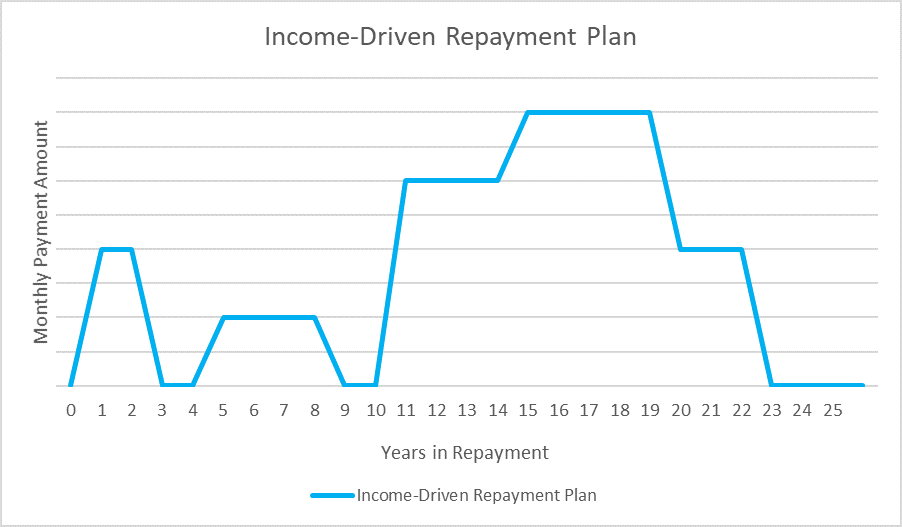

Income-Driven Repayment Plans (IDR):

These plans are best for those with little to no taxable income, and allows greater flexibility in paying off your loans. These plans allow your monthly payment to be based on your income amount and your household size, and can make your payments as low as $0/month. You must re-certify this plan every 12 months, by filling out an application and sending it in with your income information (1040 or paystubs). After 25 years of re-certifying, the remaining balance of your loans will be forgiven.

If you are having trouble making payments, we do have several Deferment and Forbearance options. However, we do encourage borrowers who qualify to consider an Income-Driven Repayment Plan.

Deferment:

Deferments are available to temporarily postpone payments for certain situations, such as if you are going back to school at least half-time, facing financial troubles, on Active Duty, or unemployed. If you think a Deferment would be a good option for you, please contact a Customer Service Representative to discuss the qualifications.

Some loans will not accrue interest during a deferment period, but others do. Make sure that you know what your loans qualify for!

Forbearance:

Forbearances are available to temporarily postpone payments for certain situations, such as if you are facing financial troubles, filed for bankruptcy, or you are facing a natural disaster. If you think a Forbearance would be a good option for you, please contact a Customer Service Representative to discuss the qualifications.

All loans accrue interest during a Forbearance, so it is best to make interest payments on your loans each month to avoid interest capitalization.